Everybody graduating from college probably has only one dream in life. “Earn money and be a billionaire,” and enjoy life to the fullest. But how many of them can get there?

To be honest, almost everyone can be a billionaire provided they know and implement the “ONLY BASICS” of financial management (Managing their finances).

If the above statement is true, then what goes wrong with them and only 5% of them makes it to the dreams they want and what happens to the remaining 95%

The basic problem is 95% of young graduates try to enjoy life to the fullest first. And then they end up regretting the first part, which should be their primary objective.

The main problem starts when we teach our kids a basic mathematical concept of compound interest, we do not correlate the same with the compounding of wealth through this concept and fail to generate any interest towards savings and investing.

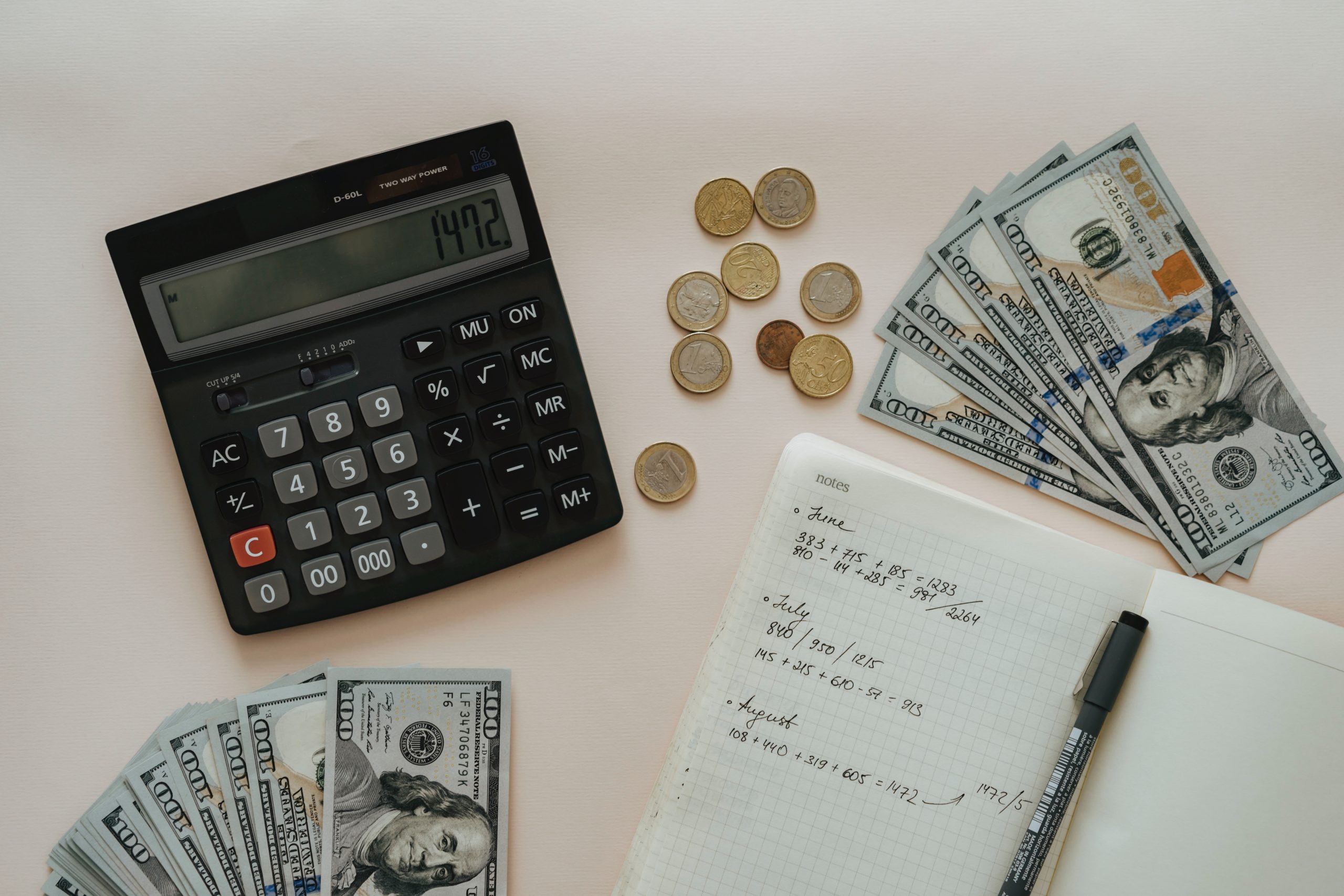

We are now coming back to where we started. Every youngster who gets into their first job wants to spend lavishly and spend money on gadgets, high-end smartphones, branded clothes etc. There is no problem with spending. The only change they have to make is to save a targeted amount out of their salary and spend the balance amount on anything they wish to. This saving, first, is crucial, however small it is. For example, a young graduate starting with a salary of INR 25000 per month, saves only 1000 per month and spend the rest of his money, will at the end of the year have INR 12000 saving and when he will invest that amount into Debt or equity and see his money grow on its own, gives him the understanding towards saving more money and putting that money into work to earn money on its own, without having to work for it, in the form of interest or dividend income or capital appreciation in Equities or any other asset class. It encourages them to save even more next time they will get their salary.

These small savings turned into an investment at an early stage of life give compounding effects later on. And the person goes towards financial freedom at an early stage of life, and a more serious approach towards this concept helps them turn into self-made crorepatis.

In today’s scenario, many youngsters will argue about finding a problem, giving a tech-based solution to that problem, and with the help of investors, they become crorepati at an early age. But, only less than 1% of the total lot makes it this way. What about the balance of 99%? The answer lies in the above example of savings, and by using the power of compounding over a sustained period, anybody or almost everybody can become a crorepati.

So before going on to reading concepts of budgeting and then financial management, learning this simple concept of savings and compounding through investing can be the right approach to achieve success in your financial life.